Complying with the IRS tax requirements and saving are important. Trying to do both is tricky but possible. There are legal ways to lower the amount paid in taxes yearly. This can be done via deductions, credits, and advanced investment strategies.

Tax strategies can be applicable in certain circumstances, such as being determined by your income level or possibly only available to self-employed or small business owners. The following are certain things that can be done to alleviate the tax burden and promote savings.

Basic savings options are available

Part-time or full-time self-employed individuals have various options available to aid with tax deductions. These can include items such as business-related vehicle mileage, which can be utilised if you conduct, for example, business as a ride-share driver. Any other expenses that have generally been incurred and are required to run a business may also provide a measure of savings on taxes.

Another not-so-familiar method of saving on taxes is to rent out rooms within a home for business meetings. This is only applicable if the business owner does not have a home office. These costs can then be deducted from the business taxes without having to claim the rental fees from the tax returns. An important thing to remember with this scenario is that rental fees have to be in line with current rental rates.

Delving deeper into the saver’s credit

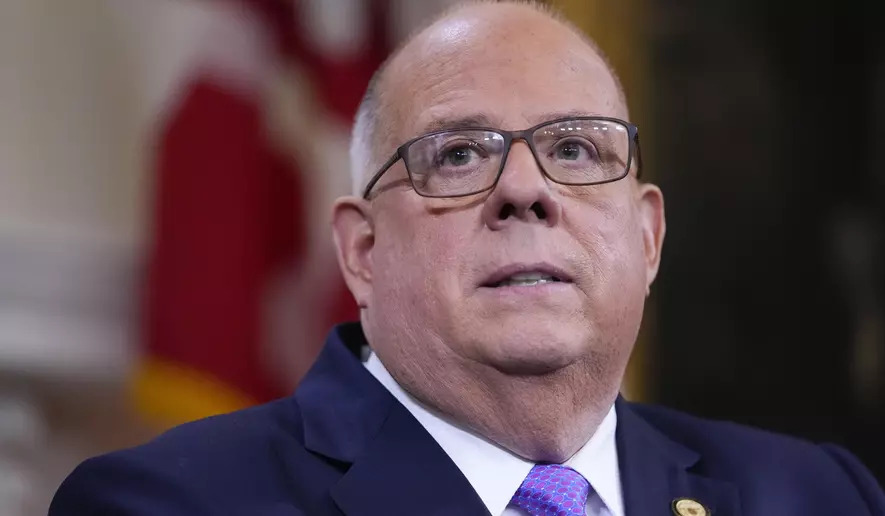

IRS Is Watching: New Enforcement Campaign Zeroes in on Specific Tax Filers

The saver’s credit is a retirement savings contribution credit. It is non-refundable. The value thereof is up to $1,000 for single filers and $2,000 for joint filers. This is calculated according to contributions made to a traditional retirement plan, 401(k). 457(b), Roth IRA, Simple IRA, etc. Contributions made to an employer-sponsored retirement plan also qualify.

The Achieving a Better Life Experience (ABLE) account only comes into the equation when the individual is the designated beneficiary. Mid- and low-income taxpayers benefit from this. Taxpayers can be eligible for 10%, 20%, or 50% of the maximum contribution amount made. These will be based on the adjusted gross income as well as filing status. With this tax credit, the actual tax bill of the individual is reduced on a dollar-for-dollar basis.

Qualifying criteria and credit limits

According to the IRS official website, to be able to qualify for this credit, contributions to a retirement plan cannot be a rollover from an existing account. For example, a 401(k) rolled over into an IRA will not be accepted. It has to be new. Other applicable criteria can be summarised as follows:

- The taxpayer may not be a full-time student

- The individual should not have been claimed as a dependent on someone else’s tax return.

- The age requirement is 18 years or older.

- Contributions should be made to a retirement plan / made to an IRA contribution.

- It must fall under the maximum AGI caps set by the IRS.

As previously stated, the credit is worth a certain percentage of the maximum contribution of $2,000 or $4,000, depending on filer status. For example, if you, as a single filer, earn $19,000 and contribute $1,000 to an account, the value of your credit would be $500. The following is a quick snippet AGI (adjusted gross income) threshold applicable to income earned in 2025:

- Other filers

- 50% of the contribution

- $35,625 or below

- 50% of the contribution

- Married couples filing jointly

- 50% of the contribution

- $47,500 or below

- 50% of the contribution

- Head of household

- 50% of the contribution

- $35,625 or below

- 50% of the contribution

There are so many benefits applicable to this tax credit. It provides a very valuable tax incentive for contributions that are made to qualified retirement plans. The credit can be claimed on the IRS Form 8880. The aim of this credit is also to encourage saving towards a retirement plan amongst your moderate- and low-income individuals.

The credit can be claimed on various retirement account contributions. Overall, it will help individuals to achieve overall long-term stability and aid to secure their financial future.