Columbia, South Carolina— Instead of the House’s plan to use $500 million to give homeowners a one-time property tax rebate, the South Carolina Senate began considering a budget on Tuesday that speeds up a planned income tax cut.

Once the spending plan passes the Senate, it will be up to three House members and three senators, likely including the budget committee leaders from each chamber, to work out the differences in South Carolina’s $15.4 billion spending plan for the next fiscal year over the next month or so. This will include the tax break and other parts of the plan.

Harvey Peeler, the chairman of the Republican Senate Finance Committee, said that the competing tax breaks were a great problem to have in the budget for the fiscal year 2024–25. This meant that politicians had a lot of extra money to spend.

Peeler has made it clear that he believes lowering the income tax rate for most people in the state from 6.3% to 6.2% with $100 million is the right thing to do. He says this is because the drop will last forever, while a property tax drop only lasts one year. The state is trying to lower its top income tax rate from 7% to 6% over the next five years.

The money comes from an account that is supposed to help people pay their property taxes. The sales tax goes into the fund, and a lot of people spent a lot of money during and after the COVID-19 pandemic, so the account is now full.

The House budget called for giving the money back as a tax break. But county leaders are afraid that next year people will be angry when their property tax bills come back.

In the Senate plan, the $500 million is used to fix roads and bridges, the water and sewer systems in local governments, and other things. It also cuts income taxes by $100 million.

One more thing that the budget conference group needs to decide is how much of a raise state workers should get. Under the Senate plan, state workers who make less than $50,000 a year would get an extra $1,375 a year. People who make more than that would get an extra 2.75 percent in pay. People who make less than $66,667 will get a $1,000 raise under the House plan, and people who make more will get a 1.5% raise.

People fought for a month last year over the budget, which had different ideas about how much money should be given to start building a new veterinary school at Clemson University. Before a deal was made in early June, there was a tense meeting where people said who cared more about people and education.

One thing that both houses agreed on was that teacher pay should go up. About $200 million is set aside in both plans. Every teacher would get a raise, and the bare minimum for a new teacher would go up to $47,000 a year. A raise for each of the first 28 years, instead of just the first 23 years, would be possible because of the budget.

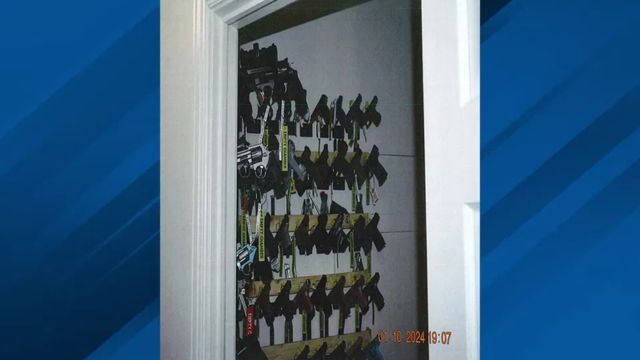

As part of the Senate plan, $36 million will be given to the Department of Juvenile Justice to improve prisons and security. Another $11 million will be used to buy technology that can find illegal cellphones in maximum security prisons and have service providers block the numbers that are likely being used by prisoners.

$150 million will be used to finish building a new school for veterinary medicine at Clemson University. Another $100 million will be used to build a new medical school at the University of South Carolina.

With almost $5 million set aside, senators want to find out where the $1.8 billion in the state Treasurer’s Office account came from and where it was meant to go.

There are $11.5 million set aside to make sure the 2024 election is fair, and another $12.5 million to improve the tools used for the election.

Puller said that the Senate budget is “balanced not only in math, but also in terms of what the state of South Carolina needs.” “Tax relief first, then public schools, and finally infrastructure.”