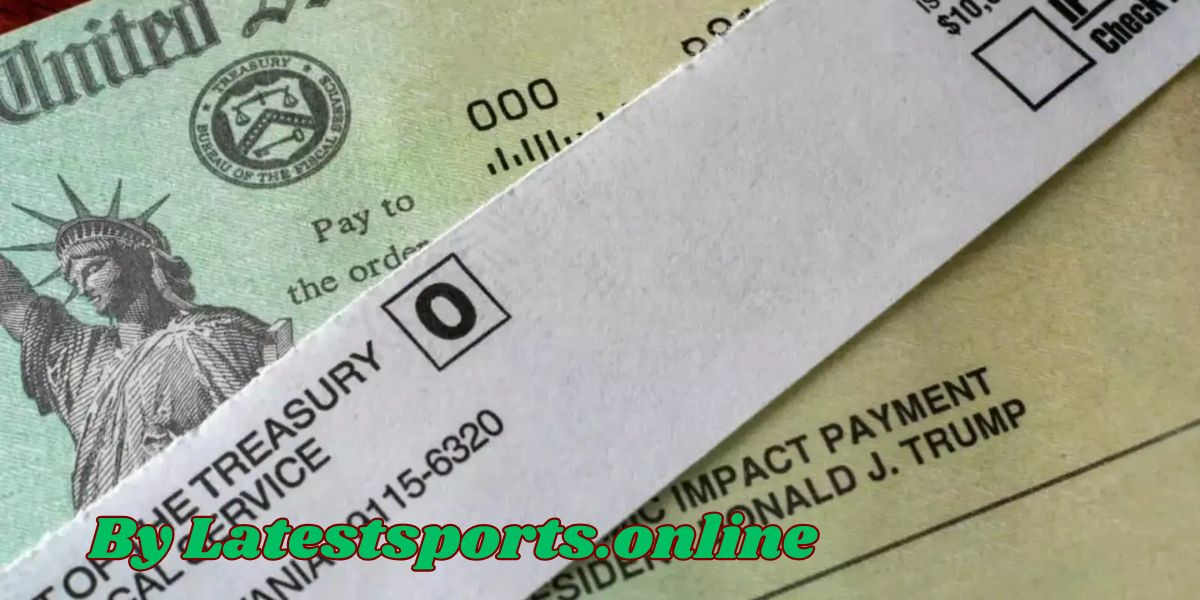

You would be surprised, but millions of people were excluded from stimulus checks in the pandemic relief package.

While many rounds of payments were issued, many eligible Americans never received a dime. Some fell behind the deadline, and others did not even know they qualified. Millions of people were left behind for stimulus checks, and people who are missing money are still out there. The Treasury Department and IRS confirmed that a significant amount of stimulus money went unclaimed due to people not filing taxes or reporting current banking information in time.

Why so many missed out

There are several reasons why millions of people did not get stimulus checks. Many times, non-filers, especially people who earned little money, just did not know they needed to take action to get paid. Others had old bank account numbers or mailing addresses, which resulted in payments bouncing or failing to arrive altogether.

The April 15th deadline was important. For others, the 15th was the deadline to file a return and receive unpaid Economic Impact Payments. If you hadn’t moved by then, the deadline for receiving your money may have technically passed.

How millions of individuals lost out on stimulus checks

Millions lost out on stimulus checks due to several different reasons. Many non-filers, especially those with no or little income, hadn’t realized they were eligible and never gave the required information. Others were absent or had outdated tax notices, so the IRS couldn’t make payments correctly.

Disinformation and confusion also played a powerful role since a great many did not know where to go for accurate advice. According to the U.S. Department of the Treasury’s official website, there are still unclaimed government funds tied to stimulus payments and tax credits.

Check to see if you qualify and take action

Even if you missed the tax deadline, you might still be eligible for other unclaimed cash or refunds. Most people do not know that unredeemed stimulus payments can have an impact on other benefits, like tax credits, too. It’s only a couple of minutes of your time to check your eligibility and possibly enjoy a nice welcome surprise you had not expected.

The majority of the people missed out on their stimulus payments because it was assumed that all had been covered. However, a cross-check with IRS transcripts, bank statements, or prior return information reveals missing payments.

Steps to follow to check if you’re owed money

- Immediately check your IRS tax transcript online.

- Review your bank records for deposit details.

- Contact the IRS by phone if you notice a missing payment gap.

- Use the IRS “Get My Payment” tool (if still available).

- Visit the U.S. Government’s official website for additional unclaimed funds guidance.

If you think you’re owed money beyond the stimulus payments, such as state rebates or tax refunds, now is the time to claim it. Billions of dollars in unclaimed cash are owed to the federal government, and it could be in your name.

Don’t leave money on the table

Although the April 15 deadline for the stimulus check has passed, that does not necessarily mean you’re in the dark. Certain federal and state government rebates and credits can still be accessed through alternative channels. It starts with knowing, and not assuming it’s too late.

Many people were kept from stimulus checks simply because they lacked information. But by staying informed, using the right tools, and checking occasionally with credible sources, you can stay ahead of what’s yours. Take it upon yourself to check for news on any upcoming relief programs or unclaimed funds. The benefits and rules can change, and being in the know may be what’s standing between you and your hard-earned money.