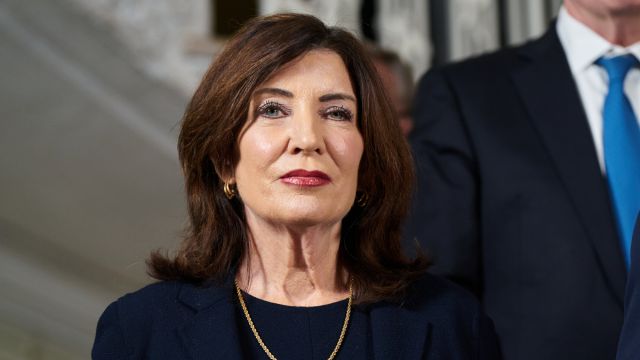

Governor Kathy Hochul has unveiled a new initiative as part of her 2025 legislative agenda: an inflation rebate program designed to ease the financial strain caused by rising living costs. If approved, the program could deliver one-time payments of up to $500 to eligible taxpayers, benefiting millions across New York State.

Who Qualifies for the Rebate?

The program targets working families and individuals within specific income brackets. Eligibility criteria include:

Timely Tax Filing: Tax returns must be filed on time.

Income Limits:

Individuals earning up to $150,000 annually are eligible for $300.

Married couples filing jointly with incomes up to $300,000 can receive $500.

This initiative is projected to assist approximately 8.6 million taxpayers statewide, offering direct financial relief to those most affected by inflation.

Details of the Rebate

EligibilityRebate AmountIncome LimitIndividual Filers$300Up to $150,000 annuallyMarried Joint Filers$500Up to $300,000 annually

The program represents a significant investment, with an estimated $3 billion in funding sourced from state tax revenues.

Objectives of the Program

Governor Hochul has emphasized two primary goals for the rebate:

- Address Inflation: Provide immediate financial relief to working families struggling with increased living costs.

- Return Excess Revenue: Redistribute the state’s surplus income back to taxpayers.

“The state should not be spending this extra income. It’s your money, and it should go back into your pockets,” Governor Hochul stated, highlighting her commitment to fiscal responsibility and supporting residents ahead of the holiday season.

Mixed Reactions from New Yorkers

The proposal has been met with mixed reactions across the state.

Supporters: Many welcome the initiative as timely and much-needed relief, especially for families grappling with inflation.

Critics: Others argue the funds would be better spent addressing long-term infrastructure issues, such as modernizing New York City’s subway system.

Approval Process and Timeline

Before the rebate can be implemented, it must pass several legislative steps:

- Legislative Session: The proposal will be discussed during the legislative session in January 2025.

- Approval Timeline: If approved, payments are expected to be distributed in March and April 2025.

Democratic lawmakers are optimistic about the proposal’s passage, citing its potential to provide direct support to millions of families. However, adjustments to the plan may arise during the legislative process.

What’s Next?

As New Yorkers await further developments, the proposed inflation rebate offers a promising step toward easing financial challenges for residents statewide.

Key Takeaways:

- Relief-Focused: The program addresses inflation-related financial strain.

- Broad Reach: An estimated 8.6 million residents stand to benefit.

- Economic Impact: The initiative aims to return surplus state revenue directly to taxpayers.

If approved, the rebate program could mark a significant moment in Governor Hochul’s agenda, providing relief and strengthening trust in state government to support its residents during challenging times.