Counties all over Montana have sent out extra tax bills because county leaders were not allowed to challenge how property taxes are calculated by a court decision.

The Lewis and Clark County Commission updated their decision on property tax billing on Tuesday. This is an important step for the county to take before they send out their own extra bills.

It was important to Commissioner Candace Payne that the money stayed with the local people. “However, we were not able to make that work.”

Lewis and Clark County is one of 49 Montana counties that chose to charge fewer mills for school equity this year. They said that these mills should be limited by inflation, like local mills. The Montana Department of Revenue said it had the power to decide how many equality mills to use. These mills are meant to make sure that all school districts get the same quality of education.

In November, the Montana Supreme Court agreed with the state and said that counties must follow how the DOR figures out the mills.

Tom Rolfe, a commissioner for Lewis and Clark County, said Tuesday, “I think we were right and the Supreme Court was wrong, but they have the last word.”

Because of this, property taxpayers in these 49 counties now have to pay an extra 17 mills. Some counties, like Lewis and Clark, that have public two-year schools will have to pay a little more than that. The extra tax is about $17 for every $1,000 that a property is worth and is taxed.

MTN talked to Terri Kunz, treasurer for Jefferson County and head of the Montana County Treasurers Association. She said that most counties now have their extra bills in the mail. She said they’re getting a lot of calls from people across the state asking about them.

Because different counties use different tools to handle their property taxes, there are differences in how the extra tax is handled from one county to the next.

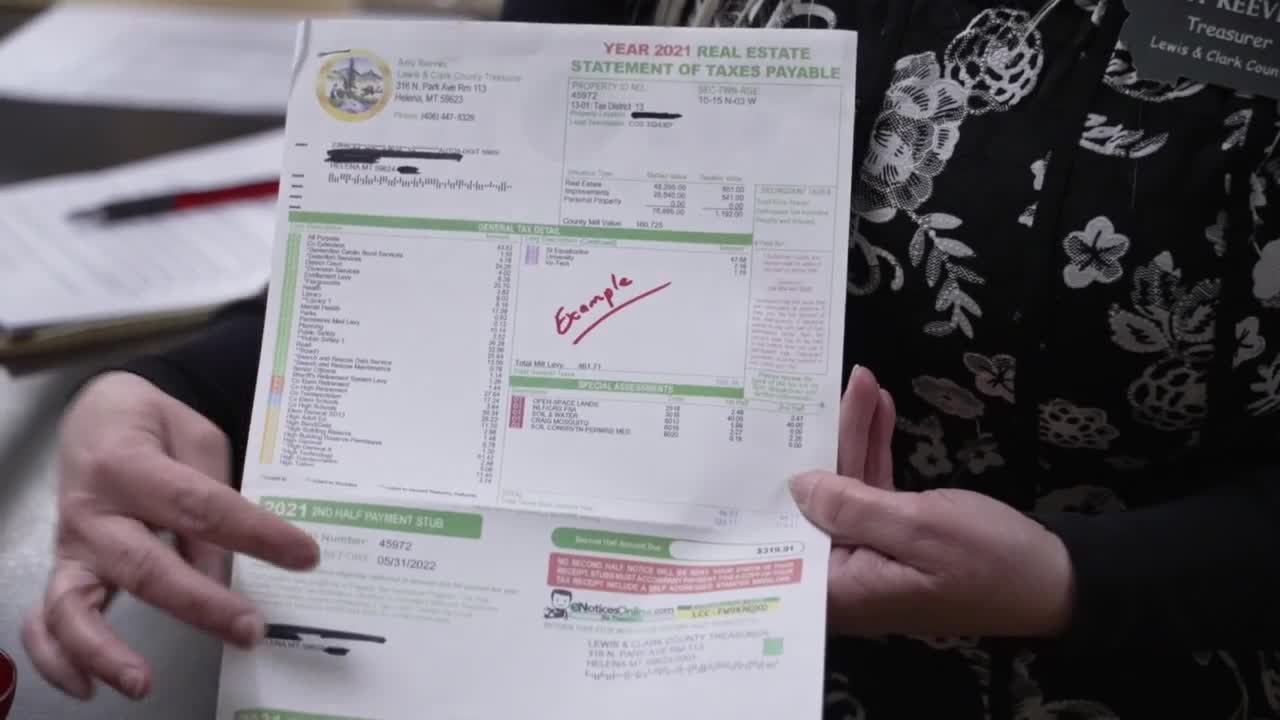

If you paid all of your taxes when the first bills came out last fall, you will probably get a second bill with only the extra 17 mills to pay. If you only paid the first half of your taxes, you will now have to pay the second half as well as the supplement. Often, these two amounts will show up on the same updated bill.

The commissioners of Lewis and Clark County decided on Tuesday not to send a bill to about 3,760 taxpayers whose extra tax would be less than $5. This is a choice that has been made by some other counties as well. They will just pay the state the amount those people would have owed instead.

Amy Reeves, treasurer, clerk, and recorder, said those small bills would be for homes worth less than $22,000 that are subject to property taxes. Many of these homes are likely owned by people who get help with their property taxes through programs. It wouldn’t be a good use of staff time or money spent on sending and printing, she said.

“We owe the state of Montana about $6,900 for those amounts less than $5, and it would have cost about $10,000 to $12,000 to get that money back,” she said.

Plus, the county has already charged some of those people a processing fee to make their minimum tax bill $5, so Reeves said they might have to pay twice.

To print and mail out extra bills, Reeves said it would cost between $30,000 and $50,000.

A lot of counties have been putting notes on the bills to answer some of the questions people may have. He said that both Lewis and Clark County will do the same thing. She plans to send the bills to the printers in a few days and send them to property owners in the next few weeks. The second-half taxes and the extra are both due on May 31.

Reeves says that you should still check to make sure that their extra bill is being paid, even if you pay your property taxes through your mortgage company.