For millions of Americans, Social Security benefits are a primary source of retirement income. While the federal government may tax a portion of these benefits based on your income, some U.S. states also levy their own taxes on Social Security, further cutting into your monthly check.

If you’re planning where to retire — or already relying on Social Security — it’s important to know which states may take a bigger bite out of your benefits. Here’s a look at the states that still tax Social Security in 2025, what that could mean for your finances, and where to consider relocating if you want to keep more of your money.

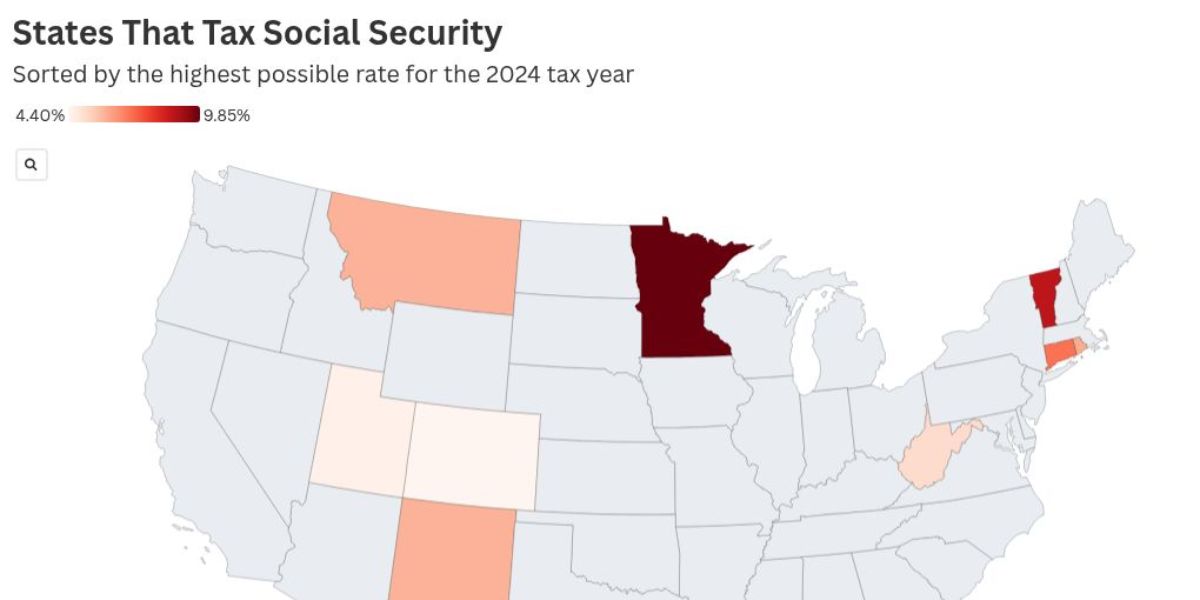

🏛️ States That Tax Social Security Benefits in 2025

As of 2025, 12 states still tax Social Security to some extent. However, not all taxes are equal — some states have income-based exemptions or offer breaks for retirees.

Here are the states that tax Social Security, ranked by how burdensome their policies can be:

🔟 1. Minnesota

-

Tax Type: Follows federal rules, but with limited deductions.

-

Why It’s High-Tax: Minnesota applies state income tax to benefits based on federal taxable amounts, and deductions phase out quickly for middle-income seniors.

🔟 2. Vermont

-

Tax Type: Based on federal taxable amount.

-

Why It’s High-Tax: Offers income-based exemptions, but middle- and high-income retirees will see part of their benefits taxed at full rates.

🔟 3. Connecticut

-

Tax Type: Partial exemption based on income.

-

Why It’s High-Tax: Individuals earning more than $75,000 ($100,000 for couples) see full taxation on Social Security benefits.

🔟 4. Colorado

-

Tax Type: Partial exemption up to a cap.

-

Why It’s High-Tax: Retirees 65+ can deduct $24,000 in retirement income (including Social Security), but lower caps apply for those under 65.

🔟 5. New Mexico

-

Tax Type: Income-based exclusions.

-

Why It’s High-Tax: While recent reforms increased exemptions, many retirees with moderate incomes may still face taxation.

🔟 6. Utah

-

Tax Type: Income-based credit system.

-

Why It’s High-Tax: Tax credits phase out quickly, so retirees with modest additional income may still be taxed on benefits.

🔟 7. Kansas

-

Tax Type: Income threshold for full exemption.

-

Why It’s High-Tax: If your federal adjusted gross income exceeds $75,000, all Social Security benefits become taxable.

🔟 8. Rhode Island

-

Tax Type: Income-based exemption.

-

Why It’s High-Tax: Full exemption applies only to individuals earning under $95,800 ($119,750 for couples).

🔟 9. Montana

-

Tax Type: Follows federal taxable income but with no state-specific deductions.

-

Why It’s High-Tax: Benefits can be taxed similarly to federal rules, with few ways to reduce the burden.

🔟 10. Nebraska

-

Update: Nebraska is phasing out Social Security taxes and aims to fully eliminate them by 2025 — making it much more retiree-friendly going forward.

🔟 11. Missouri

-

Update: Missouri passed legislation to eliminate Social Security taxes starting in 2024, joining many other tax-friendly states.

🔟 12. West Virginia

-

Update: Like Missouri and Nebraska, West Virginia is phasing out Social Security taxes, with full elimination expected in 2025.

✅ States That Do Not Tax Social Security at All

If you want to avoid state taxes on your benefits entirely, consider these Social Security tax-free states:

-

Florida

-

Texas

-

Nevada

-

Tennessee

-

Alaska

-

Wyoming

-

South Dakota

-

New Hampshire (no income tax, but taxes dividends/interest)

-

Washington

-

Arizona

-

North Carolina

-

Delaware

-

Georgia (offers generous retirement income exclusions)

These states do not tax Social Security, and many also have no state income tax, making them popular retirement destinations.

📌 Final Thoughts: Know Before You Go

When choosing where to retire, state tax policies on Social Security can make a significant difference in your financial stability. While 38 states (plus D.C.) offer full exemptions, others still take a portion — especially if you have other sources of income.

If Social Security is your main income stream, avoiding high-tax states could save you hundreds or even thousands of dollars annually. Always consult a tax advisor or financial planner before making a move, and be sure to consider other state taxes like sales, property, and retirement income when planning your ideal retirement spot.