The deadline to file your tax return is almost here. Remember that it corresponds to the 2024 tax year, and if you still haven’t submitted it, you’re still on time to benefit from a tax credit that not everyone knows about but that can help you save $1,500.

It’s the Energy Efficient Home Improvement Tax Credit, which lets you deduct part of the cost of home upgrades (especially the installation of water heaters).

Although many taxpayers know about deductions for children or education, this energy credit goes unnoticed by thousands of people who could apply for it. Don’t be one of them. We’ll tell you everything you need to know to claim it and access that $1,500 so it doesn’t go unclaimed.

What is this credit?

It’s called the Energy Efficient Home Improvement Tax Credit, and it’s key for people who own a home. In particular, it’s especially useful for those who spend a large part of their income on energy bills, and especially for taxpayers who live in places with extreme temperatures and often have to use heat pumps to get through the winter, or air conditioning to survive the summer. For example, Hawaii has one of the highest energy bills in the country, while North Dakota seems to spend the least on electricity.

Why does this credit exist?

This program seeks to help American households reduce their energy consumption, and it does so by rewarding those who replace their old systems with more modern and efficient versions. In this case, the focus is on heat pump water heaters (HPWH), which are up to four times more efficient than conventional models.

These appliances can represent up to 20% of the monthly electricity bill, so updating them not only means savings on the bill but also a direct deduction on the tax return.

How can I apply for it?

Are You at Risk? Social Security May Suspend Payments If You Ignore This Requirement

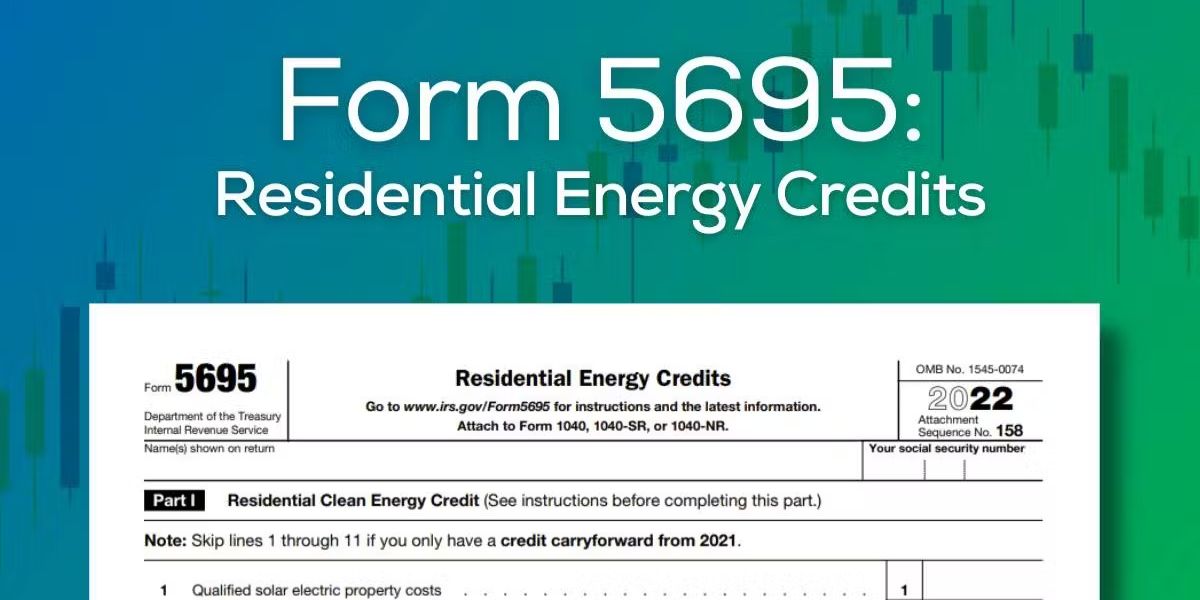

Through Form 5695, Residential Energy Credits Part II, when you submit your tax return. Remember that you must apply for this credit for the tax year in which the water heater was installed (not the year it was purchased), because otherwise it won’t count and you won’t be able to deduct it from your taxes.

Who is eligible for the credit?

- To apply for this credit, you need to meet several basic requirements:

- The heater must have been installed in a home within the U.S. after January 1, 2023.

- The property must be an existing home (not new construction).

- It must be your primary residence.

- And, of course, the unit must meet the highest energy efficiency standards set by the CEE

What if you don’t file on time?

If you’re not going to be able to file your tax return on time, request an automatic extension, but you need to do it now, because time is running out. You can also access digital tools created by the IRS itself that help you file (for free) if you meet certain requirements.

Remember that even if you request an extension, if you owe money to the government, you’ll have to pay it before April 15 of this year, and not paying could result in a late payment penalty.

Take advantage of all the opportunities the IRS offers to reduce expenses. Not everything during tax season is bad, as you can see!